CAI – looking beyond market openings

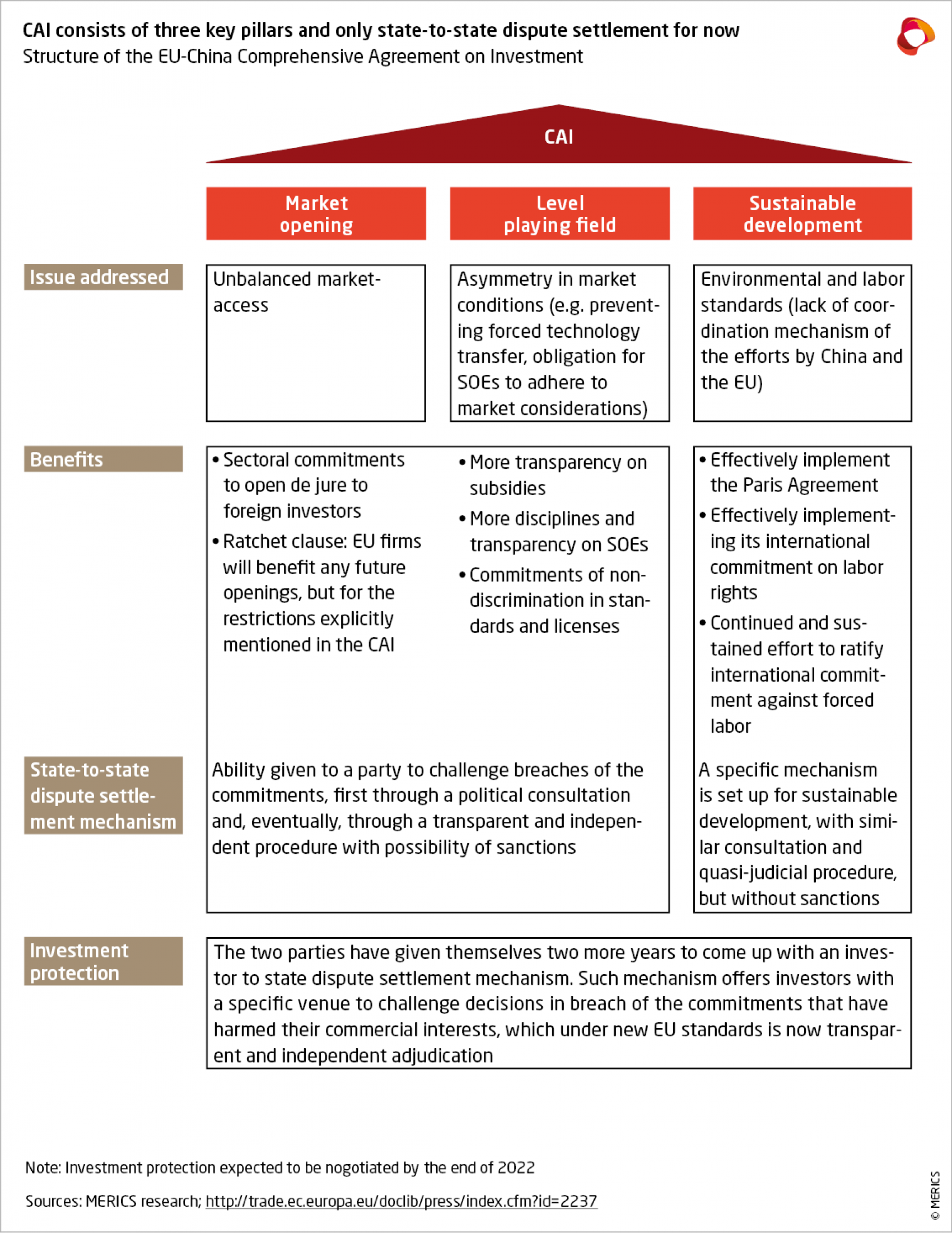

The Comprehensive Agreement on Investment (CAI), agreed in the final hours of 2020, is now fully out of the woods since the details of market opening were published in mid-March. However, the complexity of this document both reflects the murky business environment foreign firms navigate in China, and the limits of what is on offer in terms of market opening. In a long-term perspective, the agreement’s real advances may lie in the enforcement and the level-playing-field pillars if they are properly implemented.

Meaningful openings limited to new energy vehicles (NEV), renewable energies and some services

With the details of the market-opening pillar now out, it is possible to see a few improvements the agreement would bring to the current trend in China for targeted opening up. First, the CAI’s ratchet clause means that any further opening up China offers will be automatically extended to EU firms. And for new energy vehicles (NEV), investments are only restricted by the utilization rate of the sector in the province and the completion of previous projects, although both restrictions are removed for investments over USD 1 billion. The value of that last commitment seems limited, considering that Tesla and its giant factory in Shanghai received similar treatment back in 2019.

In wind and solar renewables, on the top of a non-discriminatory commitment, the EU has obtained a new strong form of reciprocity that gives the possibility of capping Chinese firms’ involvement in each EU member state at the level of the market share of EU firms in China. In services, hospitals (which were already opened in 2014, on paper at least) and clinics are now open for foreign investors in eight of the largest Chinese cities, plus Hainan province. Besides, the “technological neutrality” commitment enables companies to provide services online that they offer unconstrained offline.

Contrary to expectations, cloud services remain restricted to a 50 percent equity cap. China has also committed to remove joint-venture obligations in various business services activities, such as leasing services, management consulting and various environmental services (sanitation and solid waste disposal, among others). All the opening up in services applies to all firms wherever they are based, but only EU firms benefit from the fairly independent and transparent dispute mechanisms provided by the agreement to enforce the new provisions.

Additional value beyond opening up market access – enforcement and level-playing-field commitments

The agreement’s main value-added on market access is not so much in opening up but in providing an enforcement mechanism for most of the opening up China carried out over the past few years. This offers an opportunity for tackling the multiple, murky ways in which China hinders opening up even as it formally carries it out. The substantial provisions for a level playing field, including participation in Chinese standard-setting bodies and non-discrimination in purchases from state-owned enterprises (SOEs), could also be considered as breakthroughs for EU firms to expand on the Chinese market.

All these technical points could be swept away by mounting geopolitical tensions

The current deterioration of Sino-European relations weighs significantly on the likelihood of the CAI being ratified. The Federation of German Industries acknowledged last week that “China's unyieldingly hardline stance in Hong Kong and Xinjiang clouds prospects for ratification of the CAI”. On top of that, the ambitious schedule put forward by the Commission aims at ratification in the first six months of 2022, under a French presidency of the Council. France will then be in the run-up to a presidential election in which President Macron will likely be eager not to be depicted as pro-globalization, pro-business and unconcerned about human rights.

Read more:

- European Commission: Slide presentation of the CAI by the Commission

- European Commission: Commission publishes market access offers of the EU-China investment agreement

- European Parliament (EPRS): EU-China Comprehensive Agreement on Investment Levelling the playing field with China

- Peterson Institute for International Economics: The EU-China Comprehensive Agreement on Investment: will it be a game changer?

- SME Europe: Impacts of the EU-China Comprehensive Agreement on Investment

- SCMP: EU-China investment deal faces backlash in European Parliament

- Politico: China throws EU trade deal to the wolf warriors

You are reading an excerpt of our latest MERICS Europe China 360°.

You can subscribe to this publication on an individual basis. For more information on our packages, click here.

MERICS members also have privileged access to this product. If you want to learn more about our membership model for institutions and businesses, please click here.