How EP parties see China + EV exports + Trade and Technology Council

Analysis

European Parliament elections: How do EP parties see China?

By Grzegorz Stec

The upcoming June European Parliament (EP) elections will shape the political context of EU-China relations for the next five years. The current term-ending mandate has been dominated by building the policy tools and political narrative of a de-risking approach towards China, and the election results will influence Brussels' dedication to this agenda.

While the parties in the European Parliament differ in the level of attention they give to China, there's a general consensus among the major parties: China is increasingly viewed primarily as a challenge. However, the impact of the elections should not be underestimated, as it will define whether the impetus behind de-risking will continue as we see its tools come in to use.

Why is the EP significant for EU-China relations?

The EP plays a considerable role in shaping the EU's China policy as, among others, it:

- approves the final composition of the incoming European Commission and its political party groups participate in negotiating the priorities of the next EU mandate, which will shape the practice of the de-risking agenda.

- participates in legislative processes, including trilogue negotiations with other institutions, shaping the EU’s policy toolbox towards China.

- approves the EU's budget and trade and investment agreements, crucial for implementing projects like the Global Gateway and pursuing diversification.

- generates political momentum through committee work, resolutions and MEP delegations, as seen in the context of sustainability instruments, visits to Taiwan, or grilling EU officials on China affairs.

In terms of direct influence on EU-China relations, the EP's political impact is more substantial than on the bloc’s relations with other countries. Beijing reacts more often to political statements and resolutions from the EP than other states do, often to the detriment of EU-China relations. This was made most evident in China’s response to the EU’s deployment of the human rights sanctions regime in 2021 where Beijing reacted with sanctions targeting five MEPs and the EP’s subcommittee on Human Rights, effectively quenching prospects of ratifying the Comprehensive Agreement on Investment (CAI).

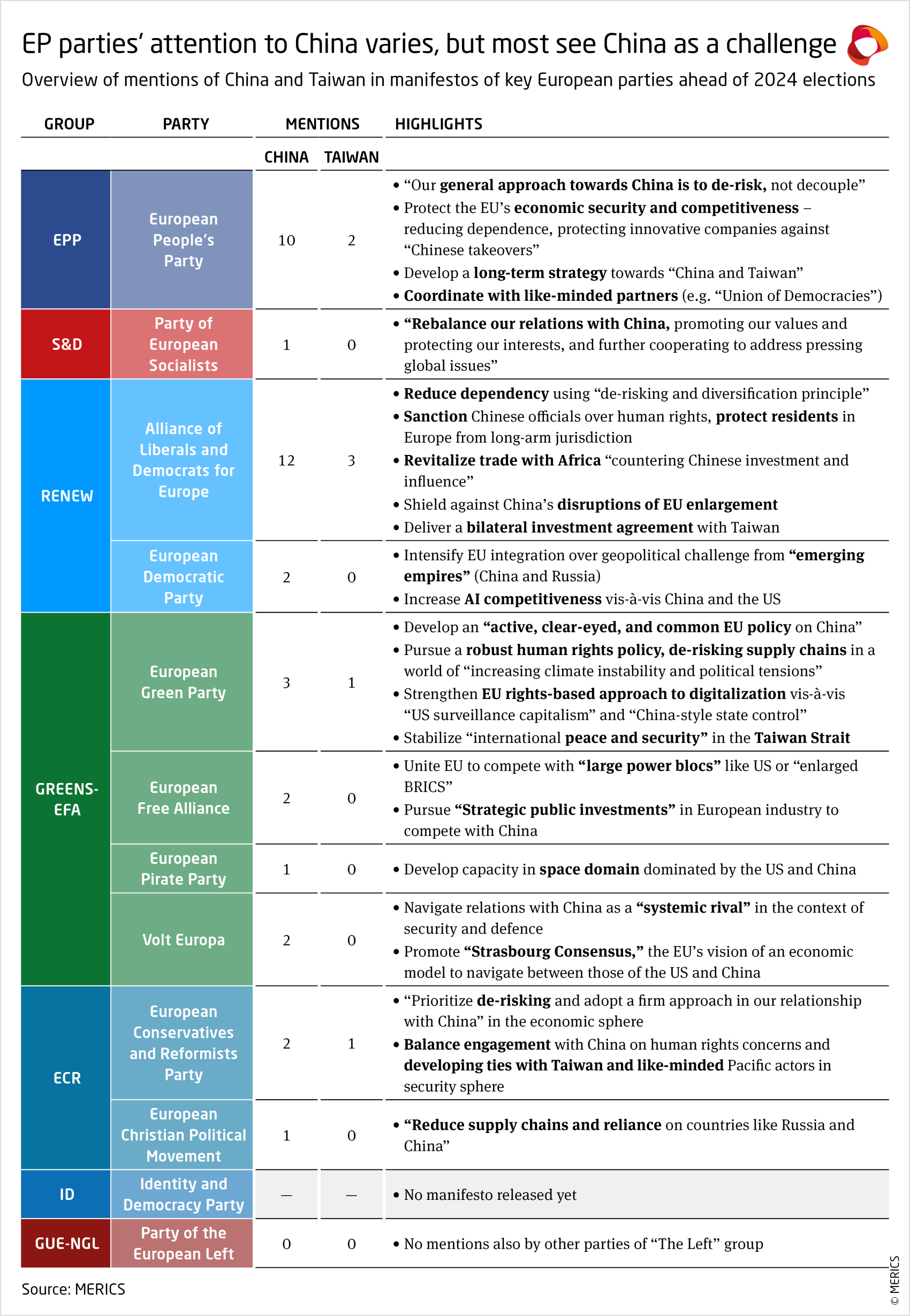

How do the manifestos of EP parties stack up when it comes to China?

The manifestos demonstrate EP parties’ varied degree of interest in China or willingness to put it among their policy priorities. European People's Party (EPP) and Alliance of Liberals and Democrats for Europe (ALDE) stand out as parties with the most robust and defined perspectives on China. As a matter of fact, they are the only ones with dedicated China strategy papers, released in 2021 and 2023 respectively.

EPP’s manifesto distinguishes itself by explicitly endorsing de-risking as the cornerstone of EU China policy and emphasizing economic security and competitiveness issues. This shouldn’t come as a surprise given that it’s key proponent, Ursula von der Leyen, is the EPP’s lead candidate for another term as Commission President. Overall, the party seems open to making responses to China-related economic and geopolitical challenges a fundamental aspect of its vision for long-term strategy for the EU.

ALDE – part of the Renew EP grouping – compared to other parties, highlights more human-rights related concerns also in the context of China’s long-arm jurisdiction towards residents in Europe. In its mentions of Taiwan, the party also goes beyond calling for maintaining stability in the Strait and voices support for Taiwan’s “right to determine its own future” and negotiating a bilateral investment agreement with Taipei.

The European Green Party (EGP) provides a concise and direct statement of interests regarding China, advocating for an “active, clear-eyed, and common” EU China policy. Beyond stability in the Taiwan Strait, the party highlights the tensions and, at times, conflicting EU interests towards China. These range from the need for a “robust human rights policy” to decreasing EU dependence on China, while acknowledging the need to navigate increased climate and political instabilities, and importance of interdependence as "a key factor for a peaceful international system and a global just transition.”

Most other parties exhibit lower interest in China policy, omitting it from their manifestos, making fewer and less robust references or introducing a generic point about the need to rebalance EU China policy with regard to values and interests.

As such, do EP parties have major differences in their positions on China?

Not really. All parties that include China in their manifestos characterize it primarily as a challenge. Remarkably, almost none of these documents outlines specific areas for cooperation with Beijing, with the omission of climate issues of note, that has typically been a non-controversial topic frequently invoked in the context of China.

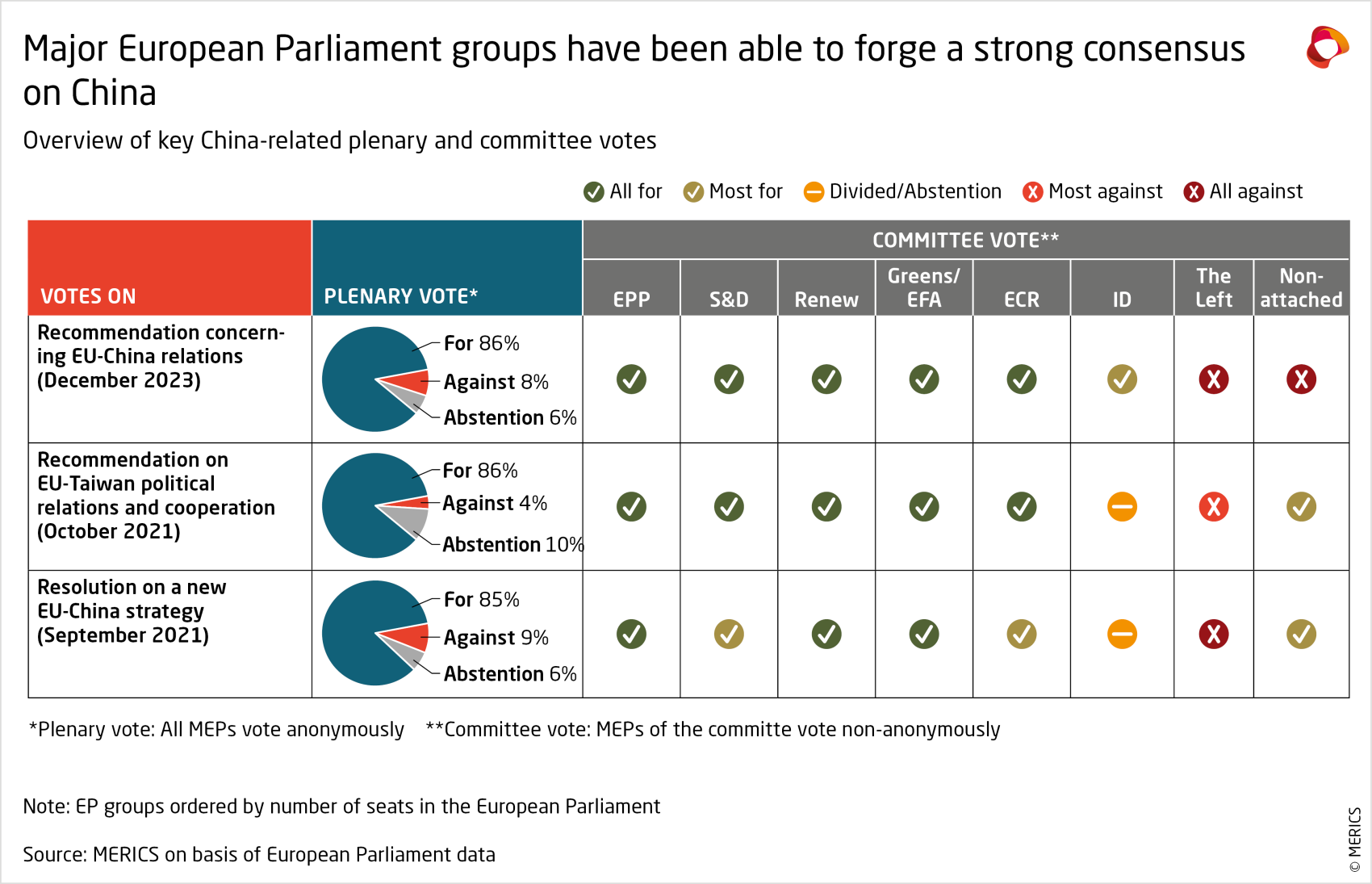

But looking only at manifestos does not paint a complete picture of the level of cohesion between EP parties on China. The voting patterns of China-related resolutions and reports highlight the EP’s ability to reach a strong consensus in its assessment of China.

In key China-focused reports and resolutions, the plenary support was always above 85 percent. The MEPs had already exhibited the same levels of alignment when voting on resolutions on Chinese countersanctions and on the concerns over the alleged forced labor and overall human rights situation in Xinjiang in 2021 and 2020 respectively.

The Committee-level voting, which shows votes of individual MEPs, points to a clear alignment between the five major political groups, with the far-right (ID) and far-left (the Left) groups having a diversified or dissenting position respectively.

So the China-positions of a newly elected EP will not change?

Not necessarily. The expected surge in votes for far-right parties may impact the political negotiations of the EU’s overall priorities and China policy, introducing a less predictable element to China debates in parliament. Also, the departure of Reinhard Bütikofer from the European Parliament, the head of the EP’s delegation for relations with the PRC and a highly-respected and influential voice in shaping Brussels discussions on China, is another destabilizing factor.

However, the strong track record of consensus-building between the major parties sets the stage for the next parliament to maintain an assertive position within the EU's China policy. Especially given that the irritant of unwarranted sanctions from China is likely to remain in place and – irrespective of whether the targeted MEPs get re-elected – the EP’s Subcommittee on Human Rights will remain a sanctioned entity by the PRC.

Still, while the overall direction appears steady, it's less clear how the EP election results will translate into specific China-policy related priorities and the implementation of de-risking measures. Naturally, factors such as Beijing's relationship with Moscow, China’s reaction to the EU's rollout of existing de-risking policy tools, responsiveness to EU’s overcapacity concerns and the state of transatlantic relations following the US elections will influence this. Nonetheless, the consensus view of China as a challenge and the support for some form of de-risking is likely to persist into the next EP mandate.

Read more:

New feature: Soapbox - MERICS data highlight

Europe-China 360° is proud to present a new regular section in our Brief, the “Soapbox – MERICS Data Highlight”, a visual discussion of topical issues in EU-China economic relations. We have teamed up with experienced trade specialist Rafael Jimenez Buendía, lecturer on International Trade at Taltech University in Talinn, Estonia, and co-founder of “Soapbox”, a free weekly newsletter solely focused on China Trade. Rafael and MERICS’ economic analyst Francois Chimits will comment on timely and relevant data regarding EU-China relations. We hope you enjoy our new supplement to this Brief.

Rafael Jimenez Buendia:

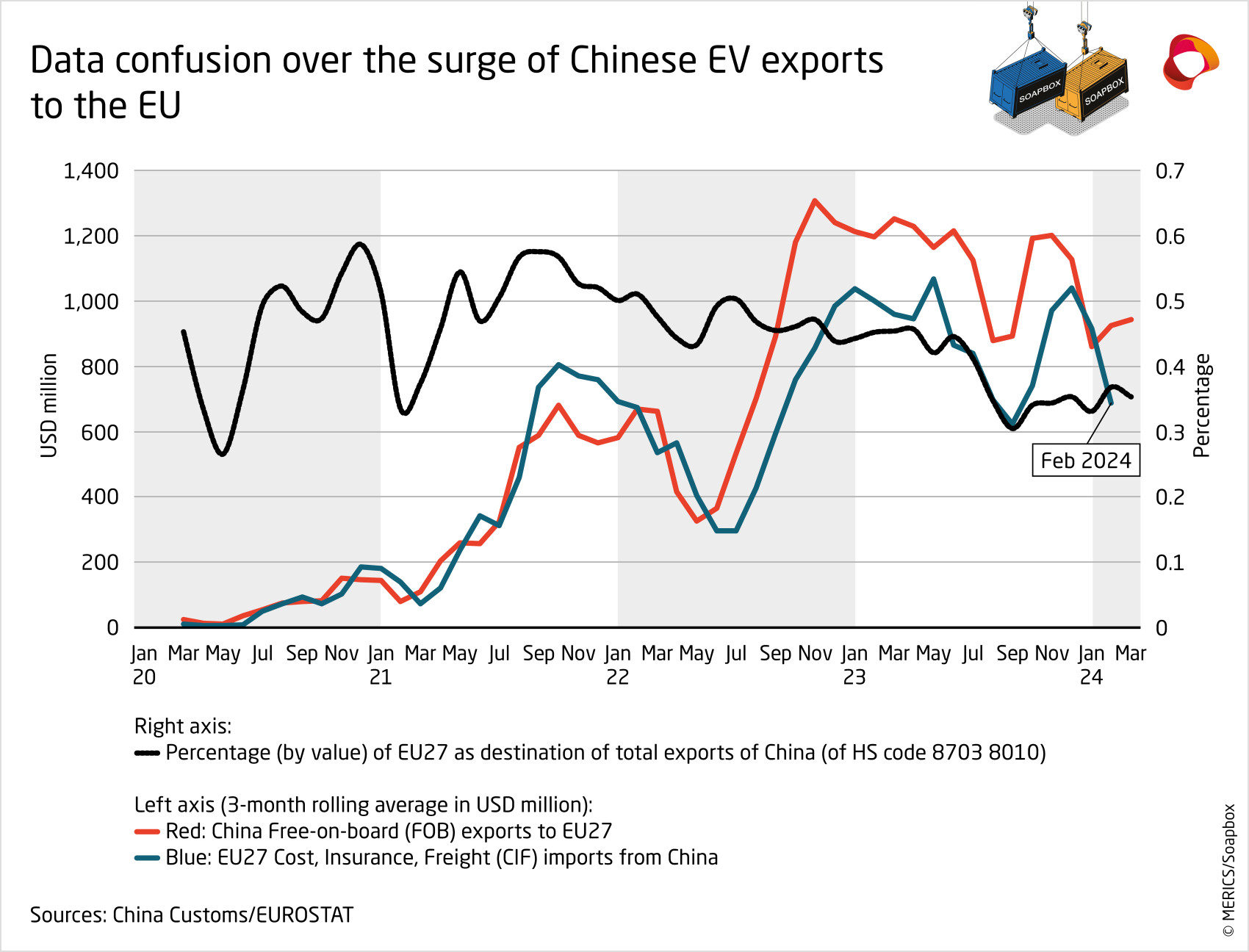

Over the past four years, the EU acted as a launchpad for electric car exports made in China. Until mid-2022, nearly half of China’s electric car exports by value were directed towards the EU. However, this percentage declined afterward as China began to export to other markets as well. Currently, over the last twelve months, the proportion of exports to the EU stands at 35 percent (as indicated by the dotted line).

A striking feature of those European imports is the abnormal higher FOB (free on board) figures reported by China than the CIF (including cost, freight, insurance, so normally higher than FOB) data reported by the EU, that began in May 2022. China Customs reports that only 46 percent of electric vehicle (EV) exports to the EU are filed under general trade. The rest are under the entrepot trade regime (海关特殊监管区域物流货物), meaning goods end-up stored with no customs duties imposed, before being eventually formally cleared for release into free circulation or to be re-exported. EU's EUROSTAT data, on the other hand, define all imports of EVs from China as normal trade. This might mean some of the registered exports to the EU on the Chinese side might be sitting somewhere waiting for a formal order to enter the EU market.

The apparent lack of reliable statistics on Chinese electric vehicles to the EU27 is disturbing, and a solution to this problem is nowhere to be seen. The China Car Association does not provide such granularity. EU statistics on sales in the single market are dispersed among member states and are not very reliable either. Unless someone has access to the bills of lading and customs declaration forms, which are restricted, we will not know who exports what amounts of EVs from China to the EU.

MERICS expert Francois Chimits:

Imports of vehicles made-in-China to the EU has continued unphased by the opening of an EU investigation into those inflows that started last October. It is important to point out that US and European carmakers remain the main drivers behind the surge, seemingly only marginally impacted by their new factories opened in Europe over the past 12 months.

Increasing EV exports of foreign brands from China to the EU are likely to increase tensions between companies’ goals and local workers' interests. This will further complicate attempts to create a more united European China policy. The next Commission will already have a difficult decision on its plate in summer, when a preliminary result of the investigation of Chinese-made EV imports is expected. It is hard to see how Brussels could take on board the interests of all the stakeholders that have skin in that essential game for the European economy.

Update

Trade and Technology Council’s cooperation on China falls short of hard expectations, but delivers soft coordination

For the second time this year, the US and the EU held a meeting of the Trade and Technology Council (TTC), on April 4 and 5 in Leuven. This sixth edition is the last of such high-level bilateral encounters before the June European elections and is most likely the last before the US presidential elections at the end of the year. Established in 2021, the Council aims to foster transatlantic cooperation on international economic matters. Most of the ten workstreams of the Council have a strong Chinese dimension, underpinning the objective of a joint EU-US response. This includes efforts from securing supply chains to addressing non-market economy distortions in global trade, as well as setting standards on green technologies or cybersecurity.

What you need to know:

- Limited concrete outcomes: the meeting established a cooperation structure for standards on Artificial Intelligence (AI) and a transparency mechanism for semiconductor subsidies. However, the agreement on securing critical raw materials remains under negotiation. Similarly, efforts to collaborate on cybersecurity standards and environmental products are still in progress.

- Some steppingstones for the future: not everything went south. The 2021 supply-chain early warning mechanism has been extended for an additional three years. The joint taxonomy on AI, initially agreed upon in 2023, was both expanded and updated. Progress is also evident in transatlantic cybersecurity interoperability, particularly in recognizing each other's standards. Similarly, there is advancing collaboration in sharing information about foreign capacities, exposures, and risks in semiconductors.

- Fruitful soft coordination: although not strictly defined as cooperation, the current economic priorities regarding China on both sides of the Atlantic have benefited from the preparatory discussions through the TTC. The EU has recently unveiled measures targeting Chinese distortions in sectors that have been prominently discussed in TTC meetings. These sectors include solar and electric-vehicle industries, telecommunication network devices, medical technologies, and legacy semiconductors, as outlined in the TTC communiqués (see entry below on recent EU measures). Similarly, the US recently updated its trade-defense instruments to better address transnational subsidies, echoing the EU's pioneering efforts in this area – a focus that aligns well with the TTC communiqués' emphasis on countering “non-market economic policies.”

The two new cooperation frameworks and the supply-chain mechanism mentioned above may appear somewhat superficial as outcomes for a critical four-year effort among like-minded allies. One contributing factor is the European reluctance to align with more aggressive US policies towards China. However, the perception of underwhelming results from the TTC may also stem from unrealistic expectations.

The EU's institutional framework restrains the Commission’s ability to endorse hard external commitments, or even structured cooperation frameworks. Member states closely monitor EU actions on anything pertaining to foreign affairs. The broader convergence of analyses and actions addressing Chinese distortions over the past four years – a key implicit objective of the TTC – more accurately reflects the benefits of this transatlantic coordination format.

Read more:

- European Commission: Joint Statement EU-US Trade and Technology Council

- South China Morning Post: EU follows US move to assess China’s dominance of legacy chips

- Politico: EU and US vow to team up against China, but can’t hide the cracks

- MERICS: EU-US Trade and Technology Council will be a litmus test for transatlantic coordination on China

Short takes

Commission’s final clampdown on Chinese distortions as mandate concludes

Recently, the European Commission initiated five more investigations against alleged Chinese distortions. Among these, two involve Chinese solar panel manufacturers linked to a significant public procurement project worth EUR 350 million in Romania. Additionally, investigations are underway concerning Chinese wind turbines featured in a private tender across five member states. Another has also been launched against a Chinese scanning machine firm. Finally, the first mobilization of the 2023 international procurement instrument targets the alleged discrimination benefiting Chinese firms in their domestic procurement market.

Parallel to these new inquiries, the Commission has concluded two separate investigations, resulting in the imposition of additional duties on chemical imports from the PRC. To date in 2024, the Commission has undertaken seven such investigations against Chinese distortions. This figure contrasts with the average of approximately ten new annual investigations conducted over the past decade against all trade partners. In April, the Trade directorate of the EU administration released an updated version of its 2017 report on Chinese distortions, adding chapters on telecom devices, semiconductors, rolling-stock, green industries and electric-vehicles.

- European Commission: Commission opens two in-depth investigations under the FSR (europa.eu)

- Official Journal of the European Union: Provisional anti-dumping duty on imports of certain alkyl phosphate esters originating in the People’s Republic of China

- European Commission – DG Trade: Staff Working Document On Significant Distortions In The Economy Of The PRC For The Purposes Of Trade Defence Investigations

- South China Morning Post: Nuctech raids leave Chinese businesses reeling as new EU foreign subsidies regulation shows its teeth

- Politico: EU to China: Open your public markets or we’ll close ours

- MERICS: Li Hui’s Europe tour 2.0 + Beijing’s mediation as seen from Kyiv + Market distortions

EU-China diplomatic calendar: France, Hungary, Italy, Poland, Slovakia

Following recent China visits of the Dutch Prime Minister Mark Rutte and the German Chancellor Olaf Scholz, the EU-China diplomatic calendar continues to be busy.

- President Xi Jinping to visit France (May 4–5), Serbia (May 6–7) and Hungary (May 8–10);

- Slovakia’s Prime Minister Robert Fico to visit China (June 23–27);

- Polish President Andrzej Duda is expected to visit China (end of June);

- Italian Prime Minister Georgia Meloni to visit China (coming months).

Beijing is likely to test and try to undermine the unity of EU positions and of European capitals’ commitment to the de-risking agenda during its engagements.

- MERICS: China conjures vision of smooth cooperation in Scholz visit

- Bloomberg: Meloni Seeks China Reset After Italy Ditches Belt and Road Pact

- Reuters: Trade will be high on agenda during Xi's visit to Paris in May, sources say

Chinese automotive companies gain ground in Europe

Regardless of the European Commission’s trade investigation into Chinese EVs, the companies have been rapidly expanding their operations across Europe after the December 2023 BYD decision to establish a massive assembly line in Hungary.

- China’s Dongfeng Motor (state-owned automotive company from Hubei) is in negotiations with the Italian government to open a factory with an annual capacity of 100,000 vehicles.

- Chery Auto (state-owned company from Anhui) is in negotiations with the Spanish government to open its first European manufacturing site in Barcelona. The deal would see Chery taking over a recently shuttered Nissan factory which led to 1.600 job losses.

- XPeng (state-owned company from Guangzhou, with a recently expanded JV with Volkswagen in China) entered the German market in recent weeks, with dealer partners in Portugal and Spain. Now the company has signed a partnership with Swedish Hedin Automotive to enter Belgium and Luxembourg.

- Bloomberg: China’s Dongfeng Mulls Making 100,000 Cars a Year in Italy

- Reuters: China's Chery nearing deal to manufacture cars in Spain

- EV: China's EV maker XPeng expands to Belgium and Luxembourg

European Commission opens new investigations into TikTok and mulls more

The investigations are being carried out under the EU Digital Services Act and carry the potential to introduce a hefty fine of up to six percent of global turnover of the targeted companies:

- February 19, 2024 – The first TikTok probe relates to the protection of minors, advertising transparency, data access for researchers, and the risk management of addictive design and harmful content.

- April 22, 2024 – the second TikTok probe focuses on TikTok Lite – a new TikTok application, investigating the mental health impact on users. The app rewards watching and liking videos with points that can be exchanged for prizes. On April 24, TikTok suspended the reward system as the investigation continues.

- The Commission is reportedly considering opening investigations into Temu, a overseas version of Chinese e-commerce platform Pinduoduo. The concerns are related to privacy and cybersecurity concerns and sales of goods that violate safety and IP standards.