Post-Covid momentum for China's global ambitions

No. 1, January 2023

What you need to know: China's new global momentum in 2023

In the first quarter of 2023, China has emerged from almost three years of Covid-19 isolation. Chinese government and business delegations are again becoming a global presence, bringing new momentum to their political, economic, corporate and technological ambitions across the world.

This edition of the MERICS China Global Competition Tracker focusses on three topics with potentially massive implications for European policy makers and companies. In the Key Player section, MERICS Senior Analyst Jacob Gunter takes a close look at the world’s largest utility company, the State Grid Corporation of China (State Grid). The company has serious global ambitions when it comes to highly innovative types of equipment and software, particularly its Ultra-High Voltage (UHV) and smart grid technologies. Europe should pay more attention to State Grid to avoid ending up in a position similar to where it is now with photovoltaic cells, where China has become the dominant supplier of a key piece of equipment in electricity generation.

In the Regional Spotlight, MERICS Analyst Aya Adachi explains the phenomenon of “Singapore-washing”. As OECD countries intensified their criticism towards corporate China, Chinese companies are confronted with navigating rising geopolitical tensions. Singapore has emerged as a key hub for Chinese corporates to “de-China” and dilute their association to China in their operations. Politically neutral and dubbed “Switzerland of Asia”, Singapore is increasingly becoming a safe haven for many Chinese companies.

MERICS Analyst Francesca Ghiretti analyzes how the EU has accelerated efforts to build deeper ties with India as a piece of the broader effort towards de-risking away from China as an economic partner. India’s growing population and market potential make it an excellent candidate for European exports and investments. EU has re-opened the negotiations for a free trade agreement (FTA) and created a Trade and Technology Council (TTC). However, India’s own strategic dependencies on China in sectors such as rare earths and active pharmaceutical ingredients (API) may hinder the EU’s de-risking strategy.

Key Player: China’s electrical utility behemoth aims to revolutionize the grid, at home, and abroad

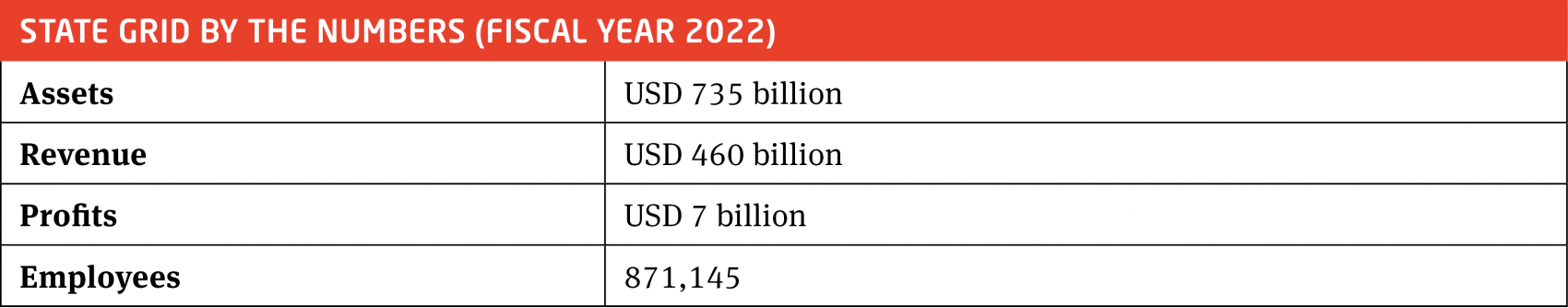

State Grid Corporation of China (State Grid) is China’s primary electric grid operator and is the largest utility company in the world and the third largest company globally (only below Walmart and Amazon in terms of revenue). The company, owned and managed by SASAC like China’s other largest centrally-owned SOEs, primarily constructs and operates China’s electrical grid covering most provinces of the country, though several southern provinces still have their own provincial SOEs managing their local grids.

State Grid is most heavily involved in the mid and downstream parts of the electricity value chain, meaning that it has a limited footprint in the upstream side of the business – electricity generation itself. Instead, it dominates the transmission of electricity – transmitting it from the point of generation across long distances to major hubs – as well as the distribution of electricity – dividing it up from these hubs and then distributing lower voltages to households and industrial/commercial customers. For example, electricity is generated by the new Liaoning Hongyanhe Nuclear Power Plant owned by China General Nuclear Power Group, which is then connected to State Grid’s local subsidiary which is in charge of transmitting the electricity the 100+ kilometers to the city of Liaoning where it will reach substations that break down the electricity into lower voltages and then distribute them to customers around the city.

Historically, State Grid was heavily involved in the equipment manufacturing links on the electrical grid value chain. However, in 2021, the company announced that it would follow orders from Beijing to spin off many of its non-core business lines, officially done to create more competition in the equipment industry. Nevertheless, it remains to be seen how much of the equipment manufacturing State Grid does will fall under ‘core’ operations, as it is unlikely that the company will be keen to surrender the progress it has made in certain highly innovative types of equipment and software, particularly its Ultra-High Voltage (UHV) and smart grid technologies, both of which are central to the company’s ambitions in China, as well as overseas.

State Grid’s global portfolio

The company’s overseas assets and operations are primarily run by State Grid International Development CO. Ltd., which reports 42 billion USD in assets, 14 billion USD in revenue, and 19,076 employees worldwide. While this may seem like small potatoes compared to the scale of its size in the China market, it is still significant for an electrical grid utility company to have so many assets and so much revenue generated overseas in absolute terms.

One-to-one comparisons are tricky to make between State Grid and other electric utility companies as most of State Grid’s counterparts do more than just electricity transmission and distribution (many also generate electricity and also serve as gas utilities). While State Grid measures its revenue in the hundreds of billions, its customer base in the billions, and its employee headcount in the hundreds of thousands, its potential competitors (especially if broken down into just grid operations) are much more likely to count their revenue in the tens of billions, customer bases in the tens of millions (or less!), and employee headcounts in the tens of thousands.

Nevertheless, State Grid is an absolute giant compared to the next largest utility companies, let alone if those companies were to be broken down into just electricity grid operators. This is largely due to the size of the China market and the fact that State Grid runs 88 percent of the electrical grid. Other massive electricity markets, such as the India or the US, have heavily fragmented markets with dozens and hundreds of utility providers respectively. Even in markets where there are fewer companies, or even where there is a single state-owned entity running effectively the whole grid, such as France or Japan, the domestic market is simply too small relative to China’s.

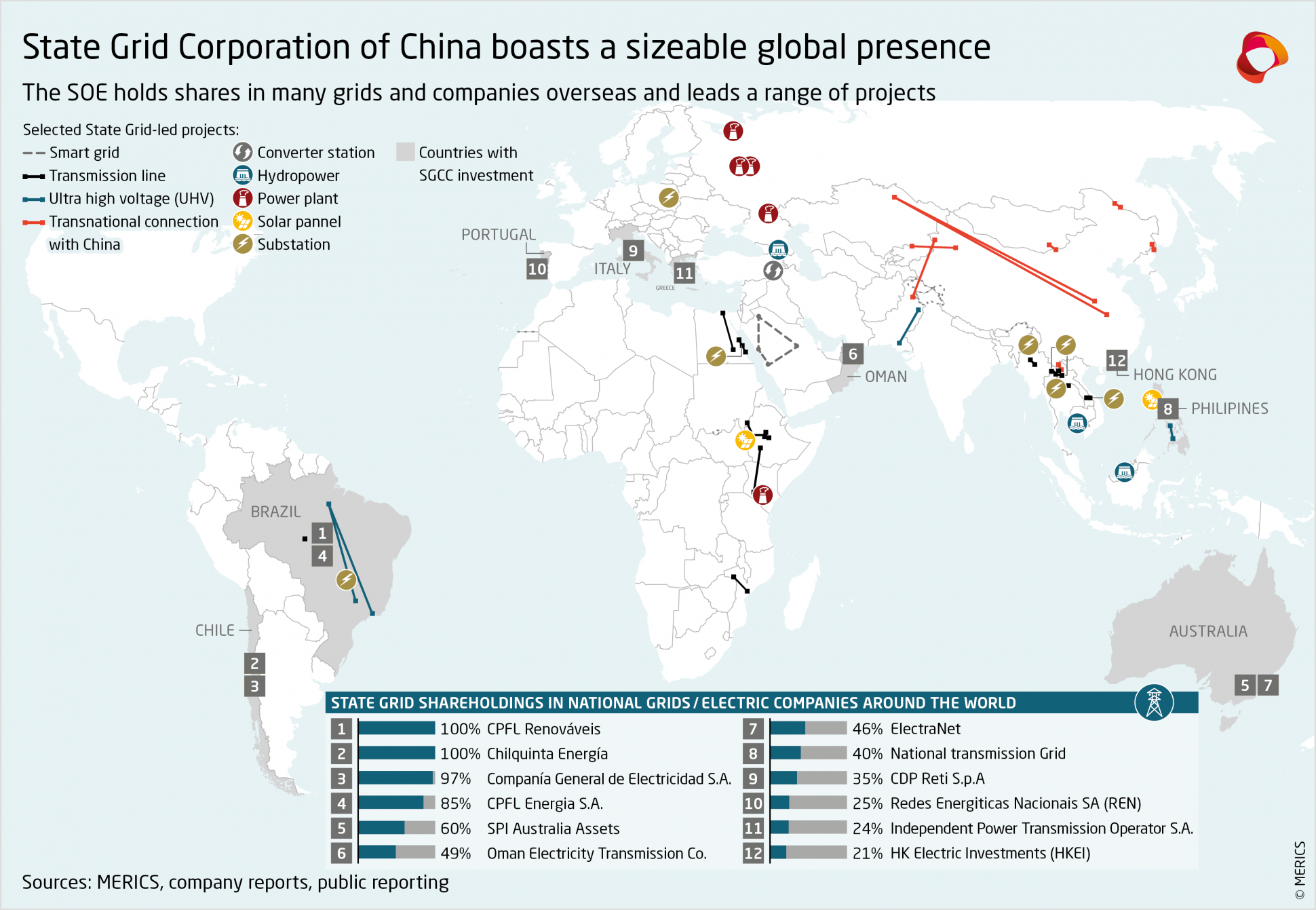

State Grid’s overseas footprint is heavily driven by sales of equipment historically, but the company has grown as an investor, a project developer, and a manager of China’s cross-border electricity transfer lines.

State Grid’s tech ambitions could massively boost its competitiveness and allure as a grid operating partner

Rather unexpectedly for a SASAC-owned SOE, State Grid is actually a major innovator and is on the cutting edge of several key technologies that will be central to grid efficiency and decarbonization.

The first technology is ultra-high voltage (UHV) transmission. China has a long history of its energy resources being distant from its population centers. Historically, the coal that made up the lions share of China’s electricity generation was most abundant and exploitable in places like Shanxi and Inner Mongolia. Considering logistics costs of moving the coal over long distances to power plants near major population centers, it would be ideal to be able to place power plants near coal deposits to save on transportation costs and instead transmit the electricity over long distances instead. The problem is that the longer the transmission distance, the more electricity is lost as it moves through the cables. The same is historically true for many of China’s best hydropower producing regions, and its natural gas hubs – they were far from the biggest sources of demand.

This is where UHV aims to come in. Perhaps oversimplifying - under ideal conditions, UHV transmission systems allow for the transmission of electricity at high voltage across long distances with less waste than traditional transmission systems. The waste can be so high in traditional systems that past certain distances, the electricity loss is so great that it is not longer economically sound to sell at the consumption end.

This technology is not only important for China to overcome inefficiencies in its still coal-reliant electricity supply, but it could also be critical for making renewables function well in the market. UHV is considered by China’s electricity industry as the answer to the fact that in a given locale, the sun doesn’t always shine and the wind doesn’t always blow. Furthermore, China’s best regions in terms of solar and wind potential are, like its coal deposits, far from population centers. UHV is seen as the solution to this quandary, as it may allow for low-waste transmission of green energy across a massive, centralized transmission network.

All of that being said, there are some doubts and limitations to UHV technology which could limit its effectiveness as a solution. First, there is the necessary scale of demand to justify costs – much of the world lacks the population density of China, let alone its issue of proximity of consumers to energy production sites. Second, there is an ongoing debate in the energy industry about whether highly centralized or decentralized systems will be best for any given region to go green, and UHV only makes sense in highly centralized grids. Third, as UHV is only applicable in highly centralized grids, it is subject to security risks that are mitigated in decentralized systems – a hostile actor can do a lot more damage over a wider area to a centralized grid by hitting key bottlenecks either kinetically or through cyberwarfare. Only time will tell if UHV tech will be as much of a game-changer as State Grid thinks it will be, but to the degree that it is, it will empower the company as it expands globally.

The second emerging sector where State Grid is most innovative is in smart grid technology. The utility giant has established itself as one of the world’s 15th largest filers of AI patents globally in 2019 according to the WIPO – as a single company it has filed more AI patents than the entirety of the Chinese Academy of Sciences. As WIPO put it in 2019, “The State Grid Corporation of China is the clear leader in energy, with 647 patent families”1. Of course, quantity of patents filed does not inherently mean that the quality of those patents are on the cutting edge. Yet, State Grid is in a perhaps uniquely well-suited position to capture the high grounds in the various core technologies that together form smart grid systems.

Due to State Grid’s unusually massive scale in its home market, the company has an abundance of data points across the electrical grid that no competitor can come close to matching, particularly at the transmission and distribution parts of the grid value chain. There simply is no other utility provider with the same amount of grid data points anywhere in the world (as covered above, unified utility companies in smaller markets can’t compete for scale, and the next largest markets in India and the US have vast numbers of utility firms splitting up the market).

The AI systems underlying smart grid technologies rely on the largest possible datasets, with machine-learning essentially ‘training’ algorithms via exposure to data points – the more of which that it has, the more advanced that a program can become. That data is gathered at both the ‘user’ and ‘asset’ levels. The former collects extensive data on household and commercial/industrial usage trends across almost all of China – with the world’s largest population and much of its industrial base. The latter gathers data along the many different types of power lines, power stations, power converters, etc.

The plethora of data collection points naturally feed into the possible applications of smart grid technology. For example, training algorithms on the usage patterns across diverse geographies and times, under different periods of supply (solar or wind availability at any given moment, limitations to hydropower supply during periods of drought, etc.) and demand (heat waves, winter storms, holiday periods and the extended production cycles that happen before them, etc.) makes smart grid systems better able to predict when, where, and how much power is needed. That data can also be used to train systems to maintain the grid itself, as usage patterns and real time monitoring of equipment can help identify ahead of time when repairs are needed or components need to be replaced. These many layers of tech, and others, are part of a bigger ambition of State Grid to build a 泛在电力物联网 – a ubiquitous electricity internet of things.2

Europe may be facing its next ‘solar panel’ dilemma, but with much more advanced tech

State Grid still has some distance to go in mastering these technologies, but to the degree that it does, and especially to the degree that it can synergize them, it could become a dominant player in decarbonization efforts. UHV tech could be a key solution to the fact that the sun is not always shining and the wind is not always blowing at all places and at all times by being able to source electricity from greater and greater distances. Smart grid tech can massively improve the efficiency of the electricity market and minimize waste while maximizing resilience of the grid. Together, they could have a considerable impact on decarbonization efforts worldwide.

In that sense, Europe may end up in a position similar to where it is now with photo voltaic cells (PVCs(solar panels)) – where China has become the dominant supplier of a key piece of equipment in electricity generation. Between human rights concerns about the material processing for PVCs in China and broader resilience concerns – after becoming dependent on gas from Russia, does Europe really want to be reliant on China for its solar power? – there are concerns about how much of that market is cornered by China’s companies. Yet, there is also a compelling argument that decarbonization must be prioritized, and if that means buying PVCs overwhelmingly from China, then so be it.

In that sense, State Grid potentially leading in UHV and smart grid techs could put Europe into a similar dilemma, though with one major difference: If Europe wanted to ‘replace’ China in PVCs for its own market, it already has the tech to do so – it just needs subsidies and scale – but Europe may not be able to ‘replace’ State Grid’s UHV and smart grid tech, which may be far more advanced than anything a European utility firm could offer as an alternative. Finally, even if Europe and some allies decide not to adopt such tech from a Chinese SOE like State Grid, there are many third markets around the world which may be eager to invite State Grid to help them with their own grid development and decarbonization strategies. That could potentially displace some of the European companies that are suppliers of more traditional grid equipment.

Regional spotlight: Singapore-washing or how Chinese corporates future-proof their global business

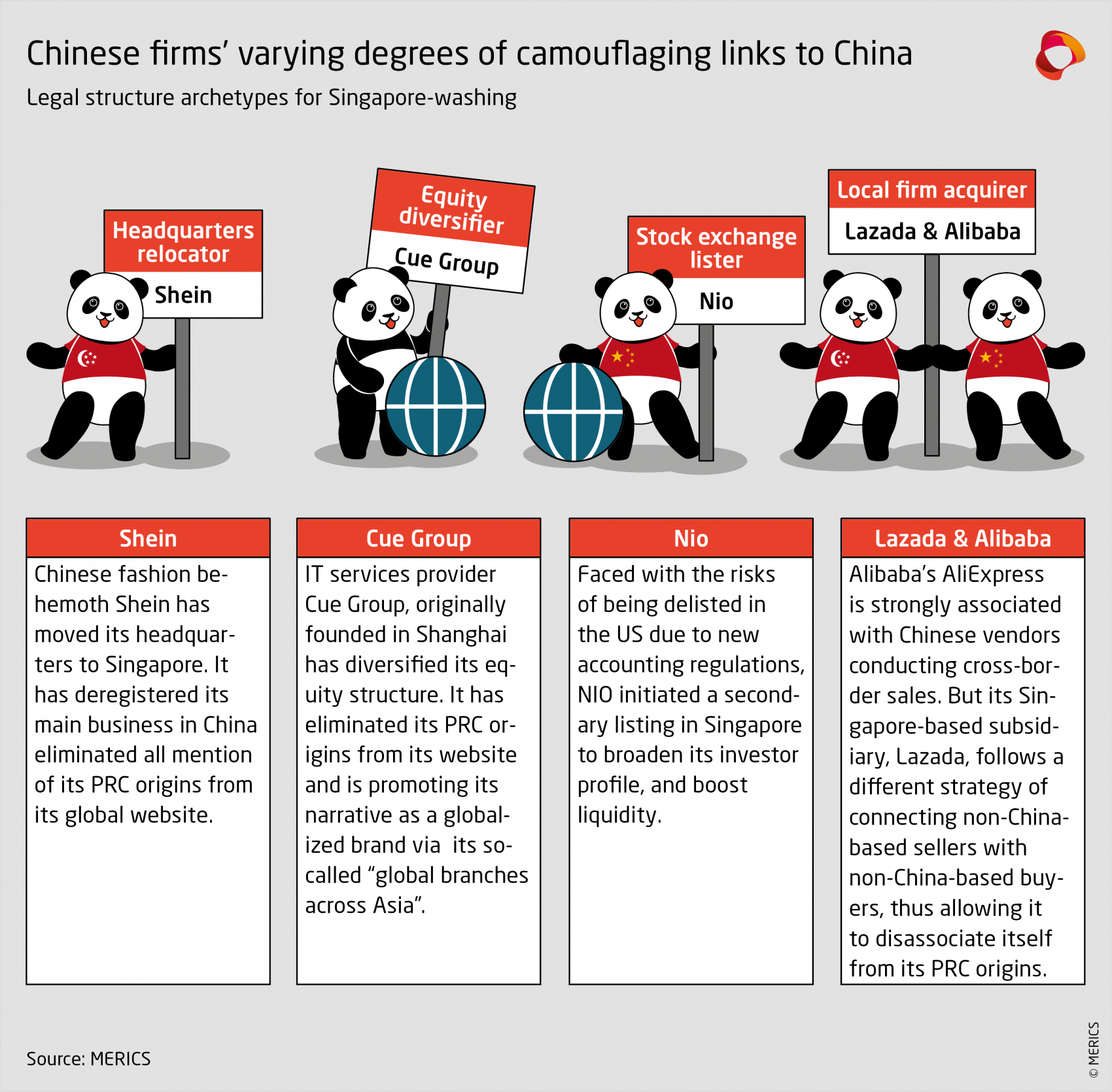

As OECD countries intensified their criticism towards corporate China, Chinese companies are confronted with navigating rising geopolitical tensions and increasingly politicized “Made in China” labels. Some foreign firms in China are trying to make their local operations separate from their global operations, and some to even look as 'Chinese' as possible to mitigate an increasingly politicized global business ecosystem. Just like their foreign counterparts, Chinese firms are future-proofing their businesses, specifically, by using Singapore as a hub to camouflage links to China or adjusting their takes to globalization in various ways. The spectrum of approaches span from keeping the Chinese brand and just shifting their global headquarters to Singapore and decoupling China from global operations, to all the way companies trying to 'appear non-Chinese'.

Chinese corporates are facing strong headwinds from growing anti-China “sentiment”: under the US China Tech War, Chinese companies and the surveillance industry in particular have been sanctioned and scrutinized for their involvement in human rights violations (e.g. Entity list, the Uyghur Forced Labor Prevention Act and Holding Foreign Companies Accountable Act);3. In Europe, Chinese companies are also increasingly subject to regulatory scrutiny through legislations such as the supply chain law or the Anti-Subsidy Regulation.

Singapore’s safe haven for all sides

Singapore has emerged as a key hub for Chinese corporates to “de-China” and dilute their association to China in their operations. With a large ethnic Chinese population, the city state has long track record of strong business ties to mainland China. Yet amid trade tensions, Singapore’s political neutrality has helped to propel itself into an even more attractive location to conduct business in the region. Foreign companies also see Singapore as an alternative to Hong Kong whose position as a global / regional business hub has been eroding under increasing chokehold by Beijing. In 2022, Singapore overtook Hong Kong as Asia’s biggest financial hub. More than 500 Chinese companies set up in the city state in 2022 alone, according to FT. As an established regional financial and business hub, Chinese businesses setting up in Singapore is not a new phenomenon. The city state has also long been a host regional headquarters for other globally operating companies. Politically neutral and dubbed “Switzerland of Asia”, Singapore has become the safe haven for foreign and Chinese companies. The city state government is leveraging its position to play both sides through recent moves to make itself even more attractive.

Through its handling of COVID, which struck a good balance in a way that China’s zero covid did not Singapore has continued to attract strong foreign investment flows during the pandemic. More importantly, Singapore introduced “variable capital company” (VCC) according to which hedge funds are given more flexible investment structure, including not having to publicly release shareholder names.

As a financial, trade, business and innovation hub, Singapore is trying to leverage its unique position to become the global Intellectual Property (IP) hub in Asia. An Intellectual Property Office of Singapore (IPOS) a statutory board under the Ministry of Law has been set up to advise on IP laws, maintain the IP Registers and engage business on their IP needs. In addition, the city state has successfully become ASEAN’s 1st International Searching and Preliminary Examining Authority under the World Intellectial Property Organizations (WIPO) Patent Cooperation Treaty and hosts the only WIPO Arbitration and Mediation outside Geneva. Since 2017, Singapore has been accepting international applications filed in Chinese. With the option to secure IP rights within the whole of ASEAN and Singapore being a more reliable system than the one back in China, Singapore has seen a surge in patent filings by Chinese firms to protect and manage their innovation in the South-East Asian region and beyond, in the past few years.

Chinese firms are using Singapore in a variety of ways to position themselves globally

Companies will adopt their own specific strategy for Singapore. While individual approaches differ there are certain commonalities that have emerged. Their approaches vary on the degree that they want to maintain their Chinese brand recognition and elevate its globalness or shed it entirely. The following archetypes show different legal structures that companies have adopted. One strategy does not exclude adopting an additional approach as companies can layer one top of one another.

Archtypes

Headquarters relocator

Example: Shein

Shein was originally founded in Nanjing, PRC, in 2008 and has since grown into a global fast fashion brand. In 2019, Shein de-registered its main business, Nanjing Top Plus Information Technology Co Ltd in China. Singapore-registered Roadget Business Pte, founded in 2019 has been the legal entity operating Shein’s global website since 2021. The company has eliminated all mentions of their origins from their websites and have given up on sales in the Chinese market. Its Shein App is not accessible in China. Shein has emerged as one the world's largest fast fashion marketplaces by making heavy use of influencers and discount codes and targeting the "Gen Z" generation.

Equity diversifier

Example: Cue Group

IT services provider (big data + AI) Cue, was launched by KKR through a merger of four companies in Shanghai in 2017. KKR, a US investment firm maintained a controlling stake until 2021 when Cue Group’s involvement with the Ministry of Public Security and its efforts to build a surveillance state technology was uncovered (See The Wire China report). KKR now maintains a minority share alongside other investment firms such as California-based Princeville Capital, South Korea-based Anchor Equity Partners and Hong Kong-based Baring Private Equity Asia .Since 2021, Baring Private Equity Asia has joint control over, via Cue’s Singapore holding company. Most of Cue’s employees along with most of its business have been in mainland China. Cue Group’s website does not mention the company’s Shanghai origins and lists its mainland offices alongside others in Kuala Lumpur, Seoul, Bangkok, Ho Chi Minh and other locations, as so-called “Global Branches” – thus presenting itself as a global company.

Stock exchange lister

Example: Nio

A Shanghai-based electric car company, NIO has been hedging its business against US-China tension. Following the US 2021 “Holding Foreign Companies Accountable Act”, which requires companies who are noncompliant with US auditing rules to delist from US stock exchanges, Chinese companies have been operating on unknown territory. While NIO is listed and its shares traded at the New York Stock Exchange (NYSE), NIO has initiated a secondary listing in Singapore in 2022 to broaden its investor base, to boost liquidity and offer an alternative venue for trading, thus appearing less associated with Chinese government support. Faced with supply chain issues, soaring costs or raw materials and strong domestic competition amounting to unstable sales, NIO has looked abroad for market expansion. NIO and other companies that are competitive and have a bright future ahead of them can look abroad and diversify their investment profile. As a result, Singapore along with other perceived “neutral” locations, such as Switzerland are seeing more listings by Chinese firms that are hedging their risks against US listings.

Local firm acquirer

Example: Lazada + Alibaba

Lazada an E-commerce company based in Singapore with operations in Southeast Asia was acquired by Alibaba for 1 billion USD in 2016. Alongside China’s other tech giant Tencent, Alibaba is a key investor in e-commerce business in Singapore. Alibaba later increased its stake from 51percent (in 2016) to 83 percent by investing another 1 billion. Lazada has established itself as the leading ecommerce platform in Southeast Asia. (In 2021, the marketplace had over 159 million active customers, generating 21 billion dollars of gross merchandise volume). In 2022, Lazada announced its expansion plans in Europe. While Alibaba is already active in Europe as AliExpress, the platform centers on Chinese vendors conducting cross-border sales. Instead, Lazada will operate similarly to amazon, by engaging local sellers in Europe to sell on its platform which further helps disassociating itself from its ties to China.

From recalibrating legal structures to separating business ties

Through subsidiaries and therefore legal separation from their China HQ, companies can try to distance themselves from China operations and even become less reliant from Chinese inputs. For example, the social media platform TikTok has legally separated itself from Bytedance/Douyin and is moving towards also becoming less reliant on the software and hardware from Bytedance/Douyin. To convince concerned policymakers in the US and Europe that the company is truly separated, TikTok has launched Project Texas and Project Clover as independent efforts to comply to local data security policies.

To further optimize their globalized image Chinese companies have also engaged in talent decoupling. Companies such as Shein, Tiktok and CUE have hired non-Chinese or international management staff and local PR and business consultants to devise a strategy for operations outside China. Recruiting international staff in senior position help enhance an international perception of a company.

Implications of Chinese-style recalibration and implications for Europe

Chinese firms are struggling with decoupling and geopolitics in some similar ways to how European firms in China are being affected. Chinese corporates rely on access to global markets for sustained profits and therefore are required to find new ways to stabilize their operations. While disassociation away from China may appear counterintuitive in serving nationalist economic agenda, the Chinese governments seems to recognize and tolerate the need for a pragmatic approach in evading regulatory scrutiny and anti-Chinese sentiments.

While diversification and decoupling discussions in OECD countries have unfolded, Chinese corporates are quietly taking similar measures to safeguard their business and have received less attention in Europe for doing so. Chinese companies engage in diversification, setting up separate strategies for business in and outside China including localization to avoid being caught between the crosshairs of geopolitical tensions. In addition to re-routing trade and production through ASEAN countries, Singapore – with its financial, business, administrative attractiveness – has emerged as a strategic location to conduct business from.

The EU is already worried about the impact of Chinese firms going global and what that means for the common market, as seen in a recent EU Court of Justice ruling on the Chinese park in Egypt which allowed countervailing measures (tariffs) on imports involving a Chinese company operating there. So for European stakeholders it may be useful to continue to monitor the different means through which Chinese companies are approaching globalization.

Balancing expectations and reality of India as a partner for EU’s de-risking strategy

The EU’s assessment of its relationship with China has taken strategic dependencies as starting point and from there it has developed a de-risking strategy, which also relies on the block’s relationship with other economic partners. India is one of these countries. India’s growing population and market potential make it an excellent candidate for European exports and investments as the size of India can offer many of the advantages that China’s market has.

For these reasons, the EU has accelerated efforts to build deeper ties with India as a piece of the broader effort to de-risking away from China as an economic partner. In 2022, the EU has re-opened the negotiations for a free trade agreement (FTA) with India. However, concluding an FTA can take years, thus the EU and India have in the meantime created a Trade and Technology Council (TTC) to have a platform to “deepen strategic engagement on trade and technology”. The EU-India TTC is composed only by three working groups against the ten working groups of the EU-US TTC, and remains still largely underdeveloped.

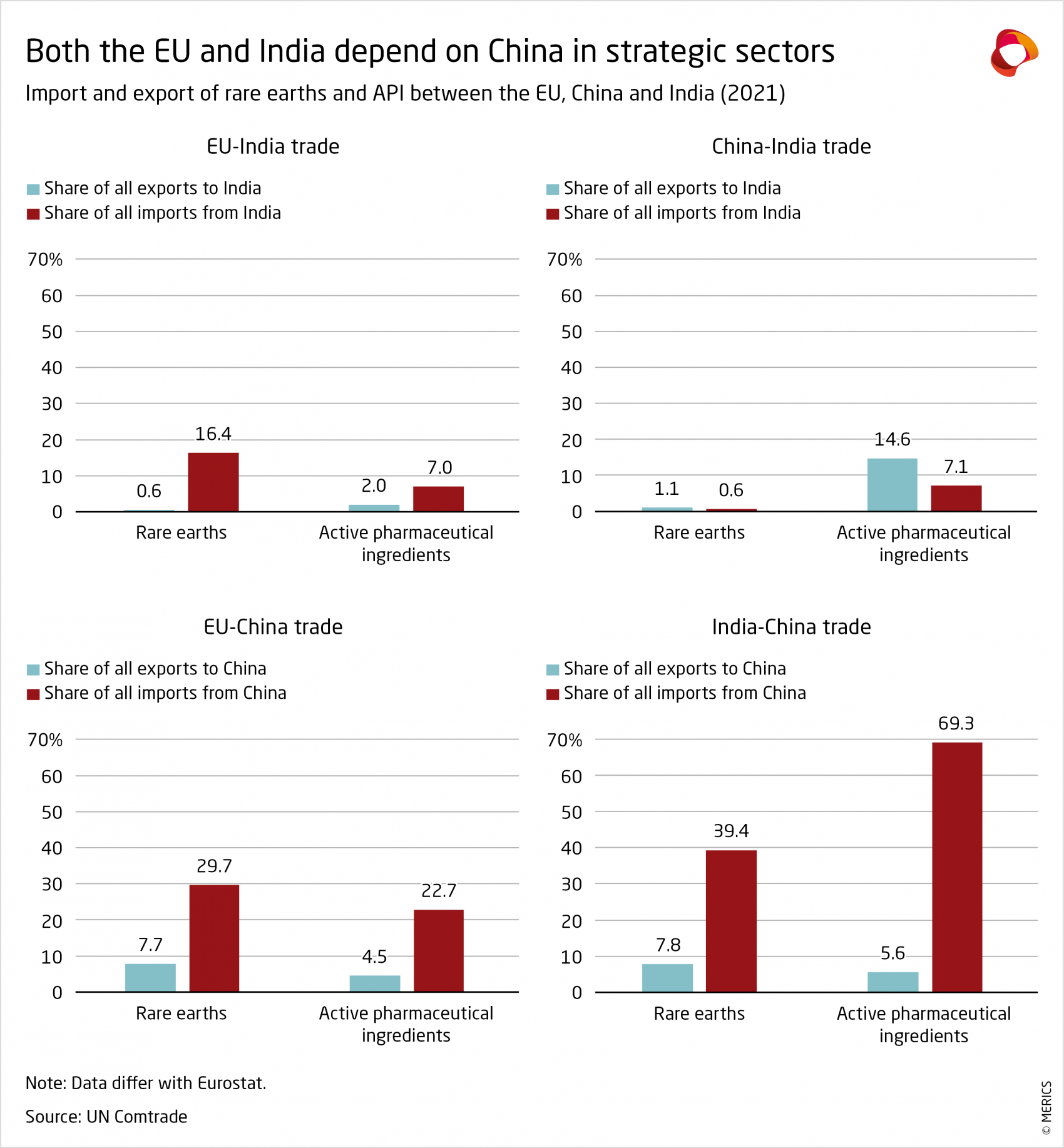

Nonetheless, India’s lack of own de-risking strategy and unwillingness to decrease strategic dependencies when they imply high costs, may hinder the EU’s de-risking strategy. If, for example, the EU bets on India to decrease its dependence on China, but India’s maintains its own dependence on China in strategic sectors, the EU may find itself increasing its own dependence on a country that is still highly dependent on China and thus, exposed to the risks that such indirect dependence may bring.

For example, data show that in two of the sectors singled out by the EU, rare earths and active pharmaceutical ingredients (API), where India’s is well positioned to play an important role in contributing to the EU’s de-risking strategy, India displays high levels of dependence on China. So far, India has either been able to do little or has assessed that decreasing dependence on China was too costly of an effort.

Critical minerals

China produces about 60 percent of the global production of rare earths and about 80 percent of rare earth processing, making the global supply chain of rare earths highly dependent on China. China is the provider of 98 percent of the EU’s supply of rare earths and as such, the EU has made reducing dependence on China for critical raw materials, of which rare earths are a core element, a priority. India holds about 6 percent of the global rare earths reserve and as such, it has the potential to become an important provider of rare earths for itself and partners, including the EU. However, India’s national production or of global shares of rare earths and their production owned by Indian companies remains to this day limited, leaving the potential of India as global provider of rare earths largely untapped, and protracting the country’s dependence on China.

On critical minerals more in general, India has done some progress. In February 2023, the Indian government has announced the discovery of a 5.9 million tons of lithium in the Salal-Haimana area of the Reasi district. Lithium is a core element to manufacture batteries for, example, Electric Vehicles (EV) and India has set itself the objective of see a wide use of EVs in its territory by 2030. If India taps into the reserve, it would become the sixth largest producer of lithium in the world. The discovery carries the potential for India to reduce its import dependence on China for lithium, and boost its own green transition and become a key partner for Europe, and others, in the achievement of goals related to a less-China dependence green transition. The problem is that the Salal-Haimana area of the Reasi district is located in the union territory of Jammu and Kashmir, a politically instable zone and seismically risky area, which complicates the access to and exploitation of such a precious resource by India.

The European Commission is taking actions in order to become more self-sufficient in the production and processing of rare earths via the Critical Raw Material Act. The EU is also seeking to secure supply of raw materials and minerals through bilateral agreements and participation in emerging plurilateral formats. For example, it is exploring a potential trade agreement for critical minerals with the US and it is taking part in multi-stakeholder partnership such as the expanding Mineral Security Partnership (MSP) with Australia, Canada, Finland, France, Germany, Japan, Italy, the Republic of Korea, Norway, Sweden, the United Kingdom, the United States, and the European Union. The MPS has already engaged with countries like Angola, Botswana, the Democratic Republic of the Congo, South Africa, Tanzania, Uganda, and Zambia.

A notable absentee from the partners of the MSP is India. India on its part is member of the supply chain resilience initiative with Australia and Japan, and the QUAD’s rare earths cooperation, but none of the two includes the EU.

Future collaborations between the EU and India could thus occur both on bilateral and plurilateral formats. The MSP could be a good platform for multilateral engagement. Bilaterally, they could explore at Indian and European companies collaborating and investing in mining and processing in India to make India less dependent from China. Collaborations with the EU and other partners, as well as investments, can decrease the cost for India of boosting own production of rare earths and thus, change the cost-benefit assessment of New Delhi.

Active pharmaceutical ingredients

Much like for the EU, the pandemic of Covid-19 was a wakeup call for India’s dependence on China for API. India is a major global producer of generic pharmaceuticals, but it imports approx. 70 percent of API to produce pharmaceuticals from China. New Delhi has in the past considered to reduce such dependence by producing API in India, however, it soon realized that home-production of API would have resulted in higher costs than what they could be imported from China for. Locally produced APIs would therefore drive up the sale prices for generic pharmaceuticals, thus leading India to lose the price competitiveness it enjoyed. Therefore, the result of India’s risk-benefit assessment came out in favor of maintaining API dependence on China to safeguard price competitiveness in the important generics export business. India exports 20 percent of the global supply volume of generic pharmaceuticals.

India has instead decided to focus on decreasing overdependencies in non-strategic rather than strategic sectors. That brings a series of advantages. First, in those sectors diversification can be more easily achieved, second, it would not risk disrupting fundamental sectors for the country’s functioning and third, it can still bring new business opportunity for local businesses. Other actors necessary for the success of the EU de-risking strategy, especially developing economies, may be keen to follow New Delhi’s strategy. However, as far as the EU is concerned, it misses the mark, if other countries too do not invest in de-risking the relationship with China, the EU’s own strategy is significantly weakened by persisting indirect dependencies. Investments from the EU can help India boost production of API at a lower cost. After all it was foreign investments that helped creating the conditions for China to produce API at such low cost. Hence, if the EU wants to incentive India to take action in decreasing dependencies in strategic sectors too, the EU had better invest in those sectors.

Managing expectations on India

In the long-term, India has a great potential as developing large market for EU’s exports and investments as well as producer of goods that can help the EU in de-risking its relationship with China, and India’s economy can benefit greatly from a deeper relationship with the EU. However, the future of India in the EU’s de-risking strategy is still highly uncertain.

In the short to medium-term, if indeed India will focus diversification efforts in non-strategic areas, India may not be the perfect partner for the EU’s de-risking efforts in strategic sectors such as API and rare earths. However, European businesses operating in non-strategic sectors may soon have more investments and business opportunities in India. Provided these opportunities are opened to foreign businesses or can be opened via a trade agreement. In fact, India’s market access barriers and complex while at the same time, poor regulatory ecosystem still make it difficult for foreign companies to invest in China. In that regard, the EU-TTC has been identified as a goof outlet to invest in the bilateral research and development of certain innovations.

In the long-term, investments from European business in strategic sectors can lower the costs of India decreasing own strategic dependencies on China and thus, change the cost-benefit assessment made by New Delhi, strengthen India’s market and the resilience of both.

Furthermore, the pandemic has given India an opportunity to dramatically improve digitalization, and collaborations with the EU in that front can provide important step forward about digitalization in developing economies as well as data and privacy protection, areas where China has been making important successes with exporting own practices to developing economies. Therefore, existing differences, obstacles and the fact that India’s substantial contribution to EU de-risking of the relationship with China may only come in the long-term should not hamper or prevent a mutually beneficial deepening of the relationship.

Global China Inc. Updates

China Inc.’s political and diplomatic developments /BRI

Uganda turns away from Chinese contractor for BRI project

The Ugandan government, frustrated after eight years of financing delays, cancelled its USD 2.3 billion construction connection project with China Harbour Engineering Company (CHEC). Instead, it signed a memorandum of understanding with a Turkish rail construction company, to build the 273 km rail line connection from Kampala to the Kenyan border. The reason for the delays in financing might be due to more risk-averse lending practices from China - Since 2017, stricter regulations for overseas loans were imposed to avoid non-performing loans and unsustainable debt, which in the past already damaged the BRI's reputation.

BRI cooperation agreement with Turkmenistan

In January 2023, China signed a BRI cooperation agreement with Turkmenistan. The contract focuses on the exploration of possible synergies between the two economies, higher facility connectivity, policy coordination, and financial integration. Both countries are dependent on each other as Turkmenistan supplies 30 to 40 percent of China’s gas needs, and more than 70 percent of Turkmenistan’s exports go to China.

Digital, Health, and Technology

American car marker using Chinese battery technology

Ford, the American car company, will build a USD 3.5 billion battery factory in Michigan using a license for the lithium-ion phosphate technology from Chinese battery manufacturer CATL. The move comes as Ford wants to produce more locally, to decrease its emissions from its production to profit from clean vehicle tax credits. The licensing decision, instead of a joint venture, is due to the new classification of Chinese companies as “foreign entity of concern”, which are not eligible for the aforementioned tax credits under the Inflation Reduction act of 2022. It will also minimize further political blowback, as US-Chinese tensions are still tense. Additionally, contingencies in the contract anticipates possible technology bans from Beijing.

Sinopharm joint venture project

Sinopharm, the Chinese state-run drugmaker, entered into a joint-venture with its American counterpart GE HealthCare. The timeline and investment amount of their project were not yet disclosed. The only known factor is the goal of the collaboration: the development and commercialization of medical equipment with a focus on “non-premium CT and general imaging ultrasound solutions”.

Energy, Resources, and Commodities

Tanzania approves new pipeline project

In February 2023, the Tanzanian government approved the construction kick-off of their agreed USD 3.5 billion and 300 km long section of the East African Crude Oil Pipeline (EACOP) project. The goal of this project is to link the rich oil fields from the landlocked Uganda to the Tanzanian ports on the Indian Ocean. The total costs are estimated at USD 10 billion and planned operability will be in 2025. The project is being jointly developed by TotalEnergies, Uganda National Oil Company, along with China National Offshore Oil Corporation (CNOOC).

New lithium deal in Bolivia

In February 2023, the Bolivian government signed a USD 1 billion agreement with CATL, BRUNP & CMOC (CBC) for the creation of two industrial complexes with Direct Lithium Extraction (DLE) technology. The CBC are Chinese firms involved in lithium extraction, battery recycling and metal mining. As many parts of the Chinese supply chain are heavily reliant on lithium and as it only has access to 25 percent of the world's lithium reserves, China is actively expanding its grip on overseas lithium reserves. With this agreement, China will now be omnipresent in the South American Lithium Triangle (Bolivia, Chile & Argentina) at a time in which global powers are intensely competing over such critical raw materials.

Huawei to play a role in Poland’s largest green energy project

In March, plans for the construction of the largest hybrid energy farm in Central and Eastern Europe in Poland were announced. The farm will combine wind and photovoltaic power generation with a total capacity of 205 MW and will be able to supply more than 100 000 households. Huawei will act as a supplier for the project, by exporting 710 string inverters and 23 smart transformer stations, which are key components for photovoltaic power plants.

Manufacturing and Construction

New USD 2.2 billion railway project in Tanzania

In late December 2022, state-owned China Civil Engineering Construction Corporation (CCECC) and China Railway Construction Corporation (CRCC) were awarded a USD 2.2 billion construction project to finalize the final section of the Standard Gauge Railway (SGR). The 506 km long section will close the connection between the western and eastern regions of the country. This line in part of the bigger 2500 km long railway network linking Northwest Tanzania with its Indian Ocean ports. Being part of the BRI rail project, it is expected that the SGR will be opening trading routes and increase the access for Chinese firms to local markets across the region.

Progress in the China-Myanmar Economic corridor

In late February, the China Railway Eryuan Engineering Group (CREEG) resumed work on an infrastructure project which will connect Muse, near the Chinese-Myanmar border, to Kyaukphyu on the India Ocean. The construction was delayed and put into hold due to the COVID-19 pandemic and the chaos ensued by the military coup in 2021. The CMEC was established in 2017 and entails various infrastructure projects, border trade zones and urban development projects. The CMEC is of great strategic importance for China, as it would create a direct connection to the Bay of Bengal and thus act as an alternative logistic route to the strait of Malacca, albeit, not at the same level of scale.

Trade and Finance

Increase of Brazilian corn imports

As the trade war against the US, a big corn (Maize) exporter to China, is still underway and as the tensions are growing, China is diversifying its corn imports and looking for new suppliers. One such supplier is Brazil, the third-largest corn producer and second-largest corn exporter in the world. COFCO, the Chinese state-owned food processing holding company, is said to continuously wanting to smooth importing procedures and to secure reliable supplies of Brazilian corn, which will predominantly be used for livestock feed. The company has significant operations in Brazil and the rest of the Rio de la Plata region in South America dedicated heavily towards corn and soybean exports to China.

Easing of unofficial coal ban with Australia

In January 2023, China state planner, the National Development and Reform Commission (NDRC), allowed four domestic Chinese entities to import Australian coal and effectively end a two year long unofficial ban on Australian coking and thermal coal imports. The first Australian coal delivery arrived in early January in Zhanjiang. It is expected that the coal imports will gradually increase over the following months. This signals a warming up between both countries, under the new Australian government.

Chinese company’s US listing signals delicate thaw in US-China financial ties

Hesai Technology Company raised USD 190 million in an initial offering on the Nasdaq stock exchange in February, making it the largest overseas IPO of a Chinese company since ride-hailing company Didi listed in the United States. The move by the producer of laser-based sensors came after the US and China signed a deal in 2022 to allow US officials better access to regulatory and compliance information of US-listed Chinese companies. US support for the listing indicates that regulators are staying true to the agreement between the two countries.

Transport and Logistics

First battery-powered locomotive launched in Thailand

The first battery-powered locomotive built by China Railway Rolling Stock Corporation (CRRC) Dalian was delivered and put into operation in Bangkok in early January. This kind of new battery-powered train may help Thailand to reduce its carbon footprint as well as improve its rail services. The locomotive was jointly developed by CRRC Dalian and Energy Absolute Public Company Limited (EA). It can haul 2,500-ton freight trains at a speed of 70 km/h or 1,000-ton passenger trains at a speed of 100 km/h.

CIMC expands its reach in Southeast Asia

CIMC Wetrans, the logistic unit of China International Marine Containers (Group) Co Ltd, has placed its Asia Headquarters in Singapore, to further expand its global reach. The geographical position of Singapore offers various advantages and gives CIMC Wetrans access to the city-state’s trading, shipping, finance market and services. IMC has been pushing to increase its influence and presence in Asia, especially Southeast Asia, to profit from the fast-growing emerging markets and the increased need of logistics channels. As of February 2023, CIMC is already present in Indonesia, Malaysia, Vietnam, and Thailand and offering its air, sea, and container services.

Progress in the Jakarta-Bandung High-Speed Railway project

In February 2023, Indonesia and China agreed on a cost overrun of USD 1.2 billion, down from USD 2 billion, for the Jakarta-Bandung High-Speed Railway project. The project is expected to be finally completed in mid-June 2023. The project was plagued with various cost overruns and delays. Initially, the cost was estimated at USD 5.5 billion, and it was expected to be completed in 2018. However, due to land acquisition delays, unstable soil conditions and the COVID-19 pandemic, the construction stalled, and the costs rose to USD 7.36 billion in total and renegotiation were needed.

- Endnotes

-

1 WIPO https://www.wipo.int/edocs/pubdocs/en/wipo_pub_1055.pdf

2 http://energy.people.com.cn/power/n1/2019/1021/c71901-31411672.html

3 Chinese firms like SenseTime, Megvii Technology, iFlytek and Dahua Technology have

been blacklisted for providing technology to or collaborating with the Chinese government’s

surveillance efforts.